Shortages, delays and recruiting could break the bounce back, warn EFCEM and FEA

As part of an EFCEM initiative to investigate the problems caused by Brexit and the Covid-19 pandemic, FEA recently undertook research with its members covering material shortages, lead times and staffing issues.

EFCEM is the European Federation of Catering Equipment manufacturers, which is made up of foodservice equipment industry trade associations, including FEA.

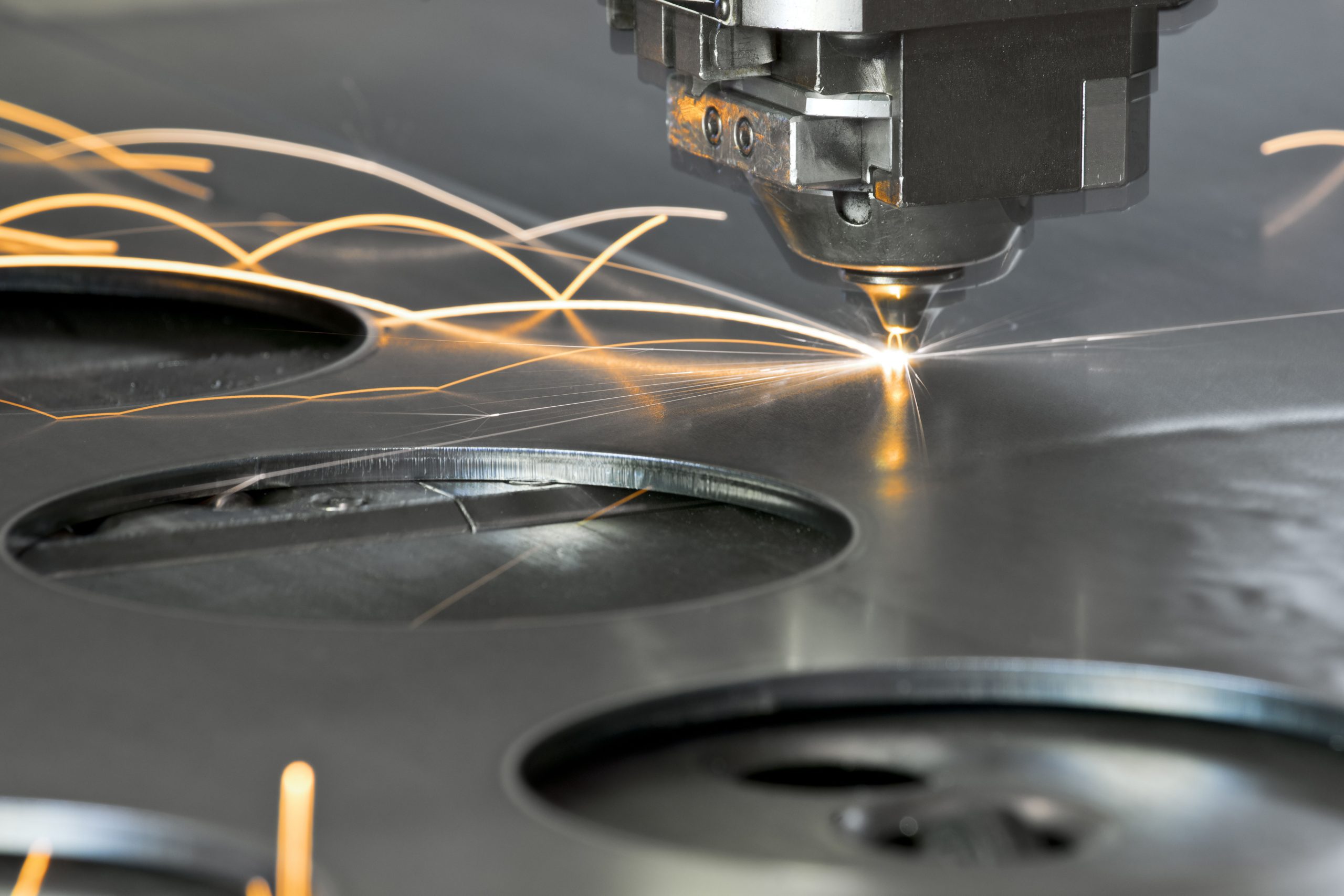

The key materials shortage for many is stainless steel, with fears that the situation may get worse. Copper, plastics, and components of all sorts are also in short supply, as are some specialist items and products like wooden utensils. One member described supply as ‘hand to mouth.’ Having said that, several companies had stocked up in preparation for expected shortages, so the impact on foodservice operator customers will be mitigated, at least in some cases.

When it comes to lead times, the situation is equally bad. Many companies are experiencing longer and longer delays. One company importing motors for its products from Italy said lead times had rocketed from four weeks to twelve, due to a combination of component shortages and logistics issues. Add in transport times, which now take up to four weeks from Europe, and you can be looking at a wait time of 18 weeks from date of order till the motors finally to get to the UK, compared to four weeks pre-pandemic and pre-Brexit.

The combination of shortages and transport issues have led to increased costs, too. One member reported two recent price rises from its stainless steel supplier, one of 5% and one of 7%. Another said the price increases of components and transport had added 15% to its costs. A third reported a 100% rise in cost for some plastics.

It’s not only products and materials coming from Europe. There are delays and cost increases on imports from the USA and Middle East. Some report that transport costs from China have risen 500%. As for India, ‘almost impossible’ was how an importer described the situation. “Where orders would previously have taken 12-16 weeks to arrive in Europe from Asia, the norm is currently now 6-7 months,” one member reported.

With staffing, the situation is mixed. Some members report reductions in staff numbers by up to 30% compared to pre-Covid levels. For others, the levels are just about the same, and for some there have actually been increases. However, the big issue here for all members is recruiting. One respondent talked about the difficulty in recruiting experienced mid-management level staff, but even unskilled labour is all but impossible to find, and if you do find them, they’ll cost more. “We’ve been told that a new warehouse person will attract a premium of 20% over the existing wage we pay,” was one member’s experience.

Phil Williams is president of EFECM. He says, “Although many FEA members are finding that their business is picking up well as we come out of lockdown, these shortages, delays and staffing issues are all huge problems that could put a massive dent in sales, wrecking the recovery. Let’s hope some are short-term problems but meanwhile we’ll be lobbying governments in the UK and Europe to put support in place and, where possible, deliver solutions.

“Until stocks are re-established effectively by supply chains, locally and internationally, and until the shipping companies have realigned their services, the recommendation is to place orders early with suppliers so that you are ahead of the queue. Manufacturers and importers have experienced procurement teams working hard on their sourcing strategy to get customers the product they need as quickly as possible – but you may need to be patient.”

FEA is a member of EFCEM.